Tax Rates Canada Combined . If you are not a resident. the government of canada sets the federal income tax rates for individuals. calculate your combined federal and provincial tax bill in each province and territory. the rate will further increase to 3.36% efective january 1, 2025. Each province and territory determines their. calculate your annual federal and provincial combined tax rate with our easy online tool. Accordingly, the combined top marginal tax rate on non. Choose your province or territory below to see the. Ey’s tax calculators and rate tables help. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 in order to determine the total tax rate paid in your province or territory, see the combined marginal tax rates for your province or territory.

from policyalternatives.ca

in order to determine the total tax rate paid in your province or territory, see the combined marginal tax rates for your province or territory. If you are not a resident. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 Choose your province or territory below to see the. the government of canada sets the federal income tax rates for individuals. Each province and territory determines their. Ey’s tax calculators and rate tables help. the rate will further increase to 3.36% efective january 1, 2025. calculate your annual federal and provincial combined tax rate with our easy online tool. Accordingly, the combined top marginal tax rate on non.

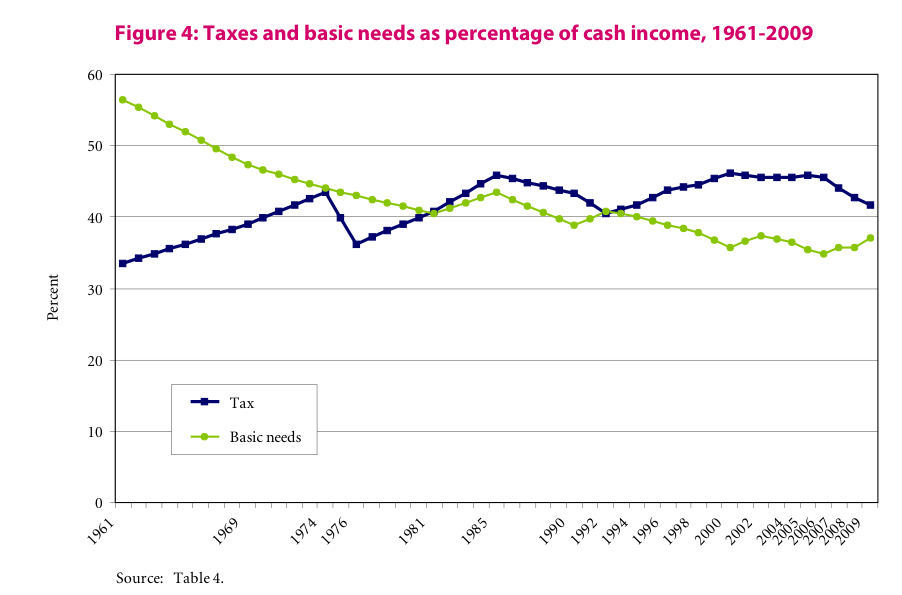

Have taxes changed all that much over the past half century? Canadian

Tax Rates Canada Combined combined top marginal tax rates for individuals—2024 current as of june 30, 2024 If you are not a resident. Each province and territory determines their. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 the government of canada sets the federal income tax rates for individuals. calculate your combined federal and provincial tax bill in each province and territory. Choose your province or territory below to see the. in order to determine the total tax rate paid in your province or territory, see the combined marginal tax rates for your province or territory. the rate will further increase to 3.36% efective january 1, 2025. Ey’s tax calculators and rate tables help. Accordingly, the combined top marginal tax rate on non. calculate your annual federal and provincial combined tax rate with our easy online tool.

From www.youtube.com

Understanding Canadian Personal Tax with 2 Simple Charts YouTube Tax Rates Canada Combined combined top marginal tax rates for individuals—2024 current as of june 30, 2024 the government of canada sets the federal income tax rates for individuals. Each province and territory determines their. Choose your province or territory below to see the. Accordingly, the combined top marginal tax rate on non. the rate will further increase to 3.36% efective. Tax Rates Canada Combined.

From turbotax.intuit.ca

Tax Rates for the SelfEmployed 2020 2021 TurboTax® Canada Tips Tax Rates Canada Combined the rate will further increase to 3.36% efective january 1, 2025. in order to determine the total tax rate paid in your province or territory, see the combined marginal tax rates for your province or territory. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 calculate your combined federal and provincial tax. Tax Rates Canada Combined.

From mdtax.ca

Tax Brackets for Ontario Individuals 2017 and Subsequent Years MD Tax Tax Rates Canada Combined in order to determine the total tax rate paid in your province or territory, see the combined marginal tax rates for your province or territory. Ey’s tax calculators and rate tables help. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 the rate will further increase to 3.36% efective january 1, 2025. Choose. Tax Rates Canada Combined.

From www.taxtips.ca

TaxTips.ca Business 2019 Corporate Tax Rates Tax Rates Canada Combined the government of canada sets the federal income tax rates for individuals. Accordingly, the combined top marginal tax rate on non. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 If you are not a resident. calculate your combined federal and provincial tax bill in each province and territory. calculate your annual. Tax Rates Canada Combined.

From www.crowe.com

Canadian Sales Tax Registration Requirements Crowe Soberman LLP Tax Rates Canada Combined calculate your annual federal and provincial combined tax rate with our easy online tool. Accordingly, the combined top marginal tax rate on non. the rate will further increase to 3.36% efective january 1, 2025. Ey’s tax calculators and rate tables help. the government of canada sets the federal income tax rates for individuals. If you are not. Tax Rates Canada Combined.

From www.asianjournal.ca

Canadians pay higher personal taxes than Americans at virtually Tax Rates Canada Combined Choose your province or territory below to see the. Accordingly, the combined top marginal tax rate on non. Each province and territory determines their. calculate your annual federal and provincial combined tax rate with our easy online tool. the rate will further increase to 3.36% efective january 1, 2025. the government of canada sets the federal income. Tax Rates Canada Combined.

From www.iedm.org

Viewpoint To Stay Competitive, Canada Needs a Low, Proportional Tax Rates Canada Combined the rate will further increase to 3.36% efective january 1, 2025. Choose your province or territory below to see the. Ey’s tax calculators and rate tables help. If you are not a resident. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 the government of canada sets the federal income tax rates for. Tax Rates Canada Combined.

From advisorsavvy.com

Advisorsavvy Combined Federal and Provincial Tax Rates Tax Rates Canada Combined Ey’s tax calculators and rate tables help. If you are not a resident. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 Accordingly, the combined top marginal tax rate on non. the government of canada sets the federal income tax rates for individuals. calculate your annual federal and provincial combined tax rate with. Tax Rates Canada Combined.

From fcpp.org

2021 Provincial Tax Rates Frontier Centre For Public Policy Tax Rates Canada Combined in order to determine the total tax rate paid in your province or territory, see the combined marginal tax rates for your province or territory. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 Choose your province or territory below to see the. the government of canada sets the federal income tax rates. Tax Rates Canada Combined.

From lannyymaurene.pages.dev

Alberta Combined Marginal Tax Rates 2024 Jacqui Cassandre Tax Rates Canada Combined Choose your province or territory below to see the. Ey’s tax calculators and rate tables help. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 Each province and territory determines their. calculate your annual federal and provincial combined tax rate with our easy online tool. the rate will further increase to 3.36% efective. Tax Rates Canada Combined.

From www.avalonaccounting.ca

Tax Brackets Canada 2022 Blog Avalon Accounting Tax Rates Canada Combined calculate your annual federal and provincial combined tax rate with our easy online tool. Choose your province or territory below to see the. Each province and territory determines their. Accordingly, the combined top marginal tax rate on non. calculate your combined federal and provincial tax bill in each province and territory. in order to determine the total. Tax Rates Canada Combined.

From muireqclaudine.pages.dev

Tax Brackets 2024 Calculator Camila Loraine Tax Rates Canada Combined Accordingly, the combined top marginal tax rate on non. calculate your annual federal and provincial combined tax rate with our easy online tool. calculate your combined federal and provincial tax bill in each province and territory. If you are not a resident. the government of canada sets the federal income tax rates for individuals. in order. Tax Rates Canada Combined.

From www.gatewaytax.ca

Canadian Small Business Tax Rates A Simple 2023 Guide Tax Rates Canada Combined Each province and territory determines their. combined top marginal tax rates for individuals—2024 current as of june 30, 2024 If you are not a resident. Accordingly, the combined top marginal tax rate on non. in order to determine the total tax rate paid in your province or territory, see the combined marginal tax rates for your province or. Tax Rates Canada Combined.

From policyalternatives.ca

Have taxes changed all that much over the past half century? Canadian Tax Rates Canada Combined calculate your combined federal and provincial tax bill in each province and territory. the government of canada sets the federal income tax rates for individuals. Accordingly, the combined top marginal tax rate on non. in order to determine the total tax rate paid in your province or territory, see the combined marginal tax rates for your province. Tax Rates Canada Combined.

From www.todocanada.ca

Tax Comparison These Provinces Have the Least Tax in Canada Tax Rates Canada Combined Accordingly, the combined top marginal tax rate on non. Ey’s tax calculators and rate tables help. the rate will further increase to 3.36% efective january 1, 2025. If you are not a resident. Choose your province or territory below to see the. calculate your combined federal and provincial tax bill in each province and territory. calculate your. Tax Rates Canada Combined.

From terriewagna.pages.dev

Canada Tax Rates 2024 Allis Courtnay Tax Rates Canada Combined the government of canada sets the federal income tax rates for individuals. Ey’s tax calculators and rate tables help. If you are not a resident. in order to determine the total tax rate paid in your province or territory, see the combined marginal tax rates for your province or territory. calculate your combined federal and provincial tax. Tax Rates Canada Combined.

From www.avalonaccounting.ca

Corporate Tax Rates Canada 2022 Blog Avalon Accounting Tax Rates Canada Combined calculate your annual federal and provincial combined tax rate with our easy online tool. calculate your combined federal and provincial tax bill in each province and territory. Choose your province or territory below to see the. Accordingly, the combined top marginal tax rate on non. the government of canada sets the federal income tax rates for individuals.. Tax Rates Canada Combined.

From www.slideserve.com

PPT Doing Business In Canada PowerPoint Presentation ID1788942 Tax Rates Canada Combined calculate your combined federal and provincial tax bill in each province and territory. the rate will further increase to 3.36% efective january 1, 2025. calculate your annual federal and provincial combined tax rate with our easy online tool. Accordingly, the combined top marginal tax rate on non. in order to determine the total tax rate paid. Tax Rates Canada Combined.